More and more insurers are utilizing CAB and SAFER scores to assess risks and establish rates for towing insurance. Your scores significantly affect your risk acceptability and your insurance premiums.

What are CAB and SAFER Scores?

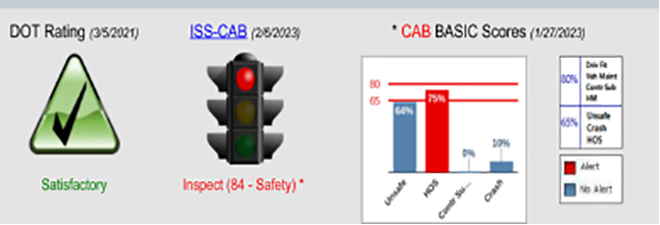

The CAB report is produced by the Central Analysis Bureau (CAB). CAB compiles millions of data points into a database for all federally filed transportation companies. DOT inspections and violations, mileage, etc. are logged into their database. CAB compiles your data into your CAB report, which compares your company against all your peer group companies.

The FMCSA Safety and Fitness Electronic Records (SAFER) system compiles a concise electronic record of a company’s identification, size, and safety information, including the safety rating of roadside out-of-service inspection summary and crash information.

Insurers use the scores and data to assess the likelihood of future claims and set insurance rates based on the perceived risk.

Impact on Insurance Rates

Towing companies with higher CAB and SAFER scores or Conditional/Unsatisfactory ratings will face higher insurance premiums. Insurance companies believe that companies with higher scores or conditional/unsatisfactory ratings indicate a higher risk of future claims. Insurers offset the risk by charging higher premiums.

Improving Scores and Lowering Rates

While CAB and SAFER scores can influence insurance rates, towing companies can take steps to improve their scores and potentially lower their insurance costs. Implementing robust safety protocols, investing in driver training programs, and a well-maintained fleet can all contribute to a positive claims history, which may lead to lower scores and more favorable insurance rates over time.

Conclusion

Understanding your CAB and SAFER scores is essential for towing companies seeking cost-effective insurance coverage. By proactively managing risk factors and maintaining a strong safety record, towing businesses can improve their scores, mitigate potential liabilities, and safeguard their operations in the competitive towing industry.

If you are interested in learning more or talking with a Wichert Insurance Towing Specialist, use the QR code below to visit our blog and website.