I have spoken to thousands of fleet owners, countless managers and the responses we get are predictable as you would expect. Many have used it for years and wouldn’t do business without it even though they may not always feel the benefits they get from telematics. Sometimes, it’s because they have a few drivers who, “they need to keep an eye on, but the majority are good.” Sometimes, it is purely a state mileage or IFTA report need, and sometimes it’s because their insurance company tells them that you must get a better rate or to have insurance at all.

So why? What do the real numbers say? Why do insurance companies and brokers send more referrals to Azuga than any other groups we know?

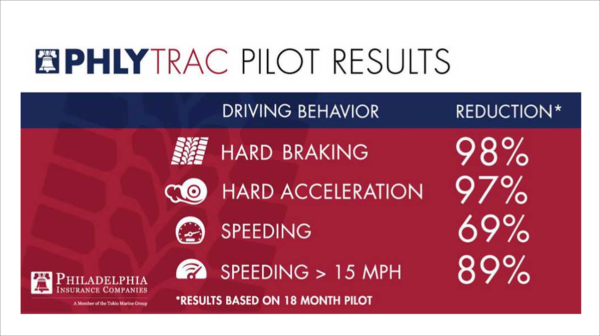

Philadelphia Insurance Companies did the work of looking at driver behavior and how Azuga Telematics system affected the results over an 18-month pilot. Here is what they found:

So, just the telematics system would reduce harsh braking events by 98%, acceleration by 97% and speeding over 15 MPH by 89%! Ask yourself, how would this help my bottom line? How much in fuel, maintenance, citations and how many upset phone calls from John Q public would this eliminate? Now think about it from the insurer’s point of view. How many claims would this prevent, and how would safer drivers affect a fleet’s insurance premiums?

Cameras have changed the game for insurers, and I firmly believe that there is coming a time, very soon, when you won’t be able to get fleet insurance without cameras at least facing forward and driver. For several years insurance companies have been forced to settle accident claims at a very high rate because aggressive attorneys have targeted commercial fleets and business-related vehicles. Basically, if you have a company name on the door of your vehicle you were being targeted. The burden of proof of who was to blame for an accident fell on the fleet owner, and without it, the insurance companies found it was cheaper to settle than risk fighting and losing. This of course created thousands of copycat law firms and a sharp increase in the cost of insurance for fleets, especially towing companies!

A properly saved video gives the insurance company a fighting chance to defend you and themselves. As they have started working with fleets using cameras, they have discovered that having cameras is great, but they need to be recording events along with telematics to help paint the picture. You need to have quick and easy access to the video and be able to easily email it to them when needed. Sometimes, you need to be able to access nonevent-based video around an event. You need to be able to see if the camera isn’t working before an accident happens. They have seen many times that a company had cameras they bought online, but they get into an accident, only to find out that their cameras haven’t been recording for over a month. The video quality must be clear enough to leave no doubt.

The newest fight that the insurance companies are fighting is distracted driving. I know there are some of you guys who don’t want to watch what your driver is doing inside the truck all day, and I don’t blame you. However, you must look if there is an incident where that is needed, and I will tell you why you want it. Now these aggressive attorneys have found a loophole with a super, high success rate. They instruct their new clients to always claim that “they saw the driver of your vehicle, and they were on the phone when the accident occurred.” It doesn’t matter whether your driver was or wasn’t at fault anymore as he was distracted driving. The burden of proof that he wasn’t falls on you!

On average, 26% of all car crashes involve cell phones, 20% for commercial fleets and the average claim cost is $70,000. This is why it is important for your insurer to have access to this in your fleet.

So why do insurers recommend Azuga, especially in Towing?

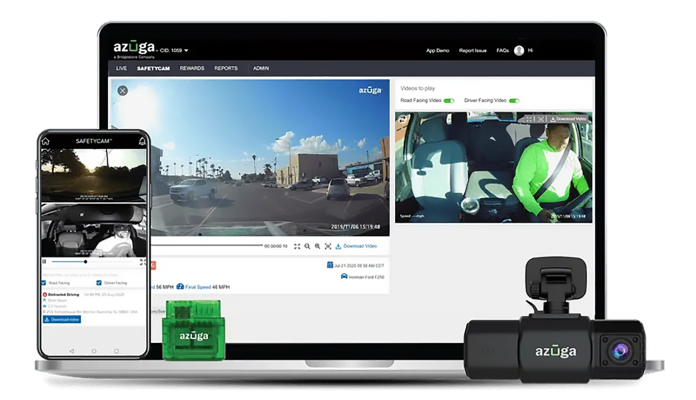

First, the internal testing they have done proves it works. The cameras have terrific picture quality and allow easy access to video whenever needed. You can access video nonevent related and can even access camera real time, if needed. Administrators can access camera health information at any time to confirm if there is anything not working, and all Azuga hardware has a lifetime warranty and free replacement.

The interior camera has AI and will notify you when drivers are on the phone while driving, distracted, not wearing a seatbelt, tailgating, eating, drinking, or smoking. It simply takes a picture and notes the telematics at that moment. As the administrator, you can customize this camera however you want, but your insurer will want it to catch cell phone events just in case.

The Azuga platform is specifically designed for towing companies. PTO notifications, state mileage reports, rear facing cameras for the back of your trucks, cameras that keep recording for an hour, even if you turn off the truck on the roadside, and internal ELD product if needed.

Azuga is a preferred provider for Towbook customers and allows customers to get updates in Towbook every 30 seconds rather than 2 minutes any other way. You also see speed, ignition status and idling time directly in Towbook. Azuga is also a preferred provider for HAAS alert which allows you to help notify oncoming traffic when you have a driver working on the roadside.

Towing is different from almost any other fleet we work with today. So, we have dedicated towing, customer success and towing technical support teams that know the towing business and can answer your specific questions.

The bottom line, Azuga gives your insurer what they want and can help you be more efficient while running your towing company. At the end of the day, the reason why insures refer you to Azuga is because it encourages safer driving, reduces the number and severity of claims, gives them access to quality video to defend their clients and can even be used to help protect the company drivers.

For More Information go to https://offer.azuga.com/towbook/ or call Tim Smith at 205-728-9135