Webfleet Solutions, one of the world’s leading telematics solution providers, dedicated to fleet management, vehicle telematics and connected car services, integrates with M2mDatasmart to provide WEBFLEET customers with the technology and ELD compliance that they require to operate their fleet. The in-vehicle technology offers an accurate electronic record of miles driven, time on the road, and progress on the route.

Webfleet Solutions, one of the world’s leading telematics solution providers, dedicated to fleet management, vehicle telematics and connected car services, integrates with M2mDatasmart to provide WEBFLEET customers with the technology and ELD compliance that they require to operate their fleet. The in-vehicle technology offers an accurate electronic record of miles driven, time on the road, and progress on the route.

While electronic driver logs are becoming more important, the real benefit of the Hours of Service application lies in its impact on planning and business efficiency. Jim William, VP of Sales of M2mDatasmart, explains how the updates of the HOS regulations can influence your towing business.

The FMCSA is revisiting four of their HOS regulations. These new revisions will go into effect on September 29, 2020, at midnight. These new adjustments to the regulations will provide more flexibility without adversely affecting safety.

The first modification expands the short-haul exception. For local drivers, the distance limit of 100 air-mile radius will be expanded to 150 air miles. Previously, this exception was only available to non-CDL drivers using a commercial vehicle over 10,000 lbs. The commercial vehicle (including a tow truck) requires an ELD device and software even when the driver had chosen an exempt status. With the 150 air-mile rule, the towing industry is given added flexibility. You can cross state lines and drive in multiple jurisdictions without recording On Duty Driving versus On Duty Not Driving time. The ELD application merely records the time simply as On Duty. Property hauling and agricultural use carriers are also given the same added flexibility. Remember, this is an exception to the federal rules. Most intrastate rule sets will eventually change to match the federal rules but may not immediately. Travel across state lines is permitted within the 150 air-miles radius exemption but if you normally use the rules for your state and you exceed the 150 air-mile radius you must continue to use Federal rules for your next complete 70 or 80-hour duty cycle. The total maximum on-duty time is also extended from 12 hours to 14 hours, but remember that the workday begins with the first DVIR inspection.

The second change will expand the on-duty driving window during adverse conditions by up to two hours. The hazardous driving exception of FMCSA 395.1(b)(1) can be used to extend driving hours in addition to on-duty hours in a single day. In the Federal system, the new totals will be 13 driving hours and 16 on-duty hours. The towing industry has long benefited from the 16 hours “Big Day” rule that is available once per week under FMCSA 395.1(o). That provision has not changed but from a practical standpoint; if you needed the 2 Hour Driving extension for Adverse Driving conditions previously, you were also forced to use that provision immediately or risk a violation.

The final rule will also allow more flexibility in breaks by requiring a 30-minute break only after 8 hours of driving time instead of 8 hours of on-duty time. On-Duty, Not Driving time will qualify for the break, allowing drivers to use the time to refuel or unload. Drivers will still be required to take a full 30-minute break at one time.

Lastly, modifications to split sleeper berth will allow the 10-hour minimum off-duty requirement to be split into a 7-hour sleeper berth break and 3 hours of off-duty time. The old rule requires 8 hours sleeper berth with 2 hours of off-duty time. Drivers will be able to choose between the 8/2 or 7/3 split. As before, a full 10 hours is still required before the cycle can be reset and the rest breaks can be taken in any order. You must be driving a truck with a full sleeper berth to use this provision.

The FMCSA has been considering updating the regulation for the last 2 years based on feedback from industry leaders. We commend them for these changes. These modifications will save motor carriers and shippers millions of dollars while adding flexibility to the drivers’ workday. Bravo

For more information, visit www.webfleet.com

H

H

GUNIWHEEL™ currently comes in two models: GUNIWHEEL™ 45 is for most standard size vehicles with 4 & 5 lug patterns. GUNIWHEEL™ 56 is for bigger trucks, vans, and large SUV’s with 5 & 6 lug patterns.

GUNIWHEEL™ currently comes in two models: GUNIWHEEL™ 45 is for most standard size vehicles with 4 & 5 lug patterns. GUNIWHEEL™ 56 is for bigger trucks, vans, and large SUV’s with 5 & 6 lug patterns.

Jerr-Dan Parts is expanding its assortment to include Buyers Products Toolboxes and Brackets. Manufactured and assembled in the USA, Buyers offers a range of toolboxes with emphasis on customer value. Brand reputation, especially one of durability and dependability is essential to Buyers, and they are proud to partner with Jerr-Dan in order to provide customers with top

Jerr-Dan Parts is expanding its assortment to include Buyers Products Toolboxes and Brackets. Manufactured and assembled in the USA, Buyers offers a range of toolboxes with emphasis on customer value. Brand reputation, especially one of durability and dependability is essential to Buyers, and they are proud to partner with Jerr-Dan in order to provide customers with top  toolbox and bracket selections. Built with durable materials like carbon steel, stainless steel, aluminum, and polyethylene, these toolboxes come in different styles and sizes, which are all available for purchase through a Jerr-Dan distributor.

toolbox and bracket selections. Built with durable materials like carbon steel, stainless steel, aluminum, and polyethylene, these toolboxes come in different styles and sizes, which are all available for purchase through a Jerr-Dan distributor.

The NRC Quick-Swap is the most versatile detach unit available on the market today!

The NRC Quick-Swap is the most versatile detach unit available on the market today!

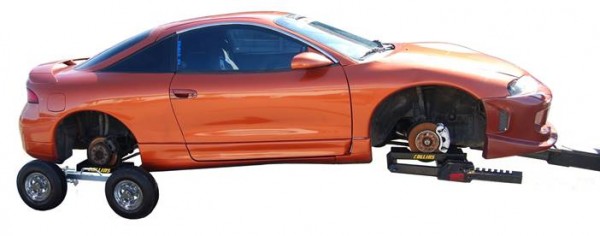

Calls for quickly moving vehicles with broken ball joints continue to grow. While many use skates or Go-Jacks, many tow-ers find that due to their inability to safely load and secure a vehicle, especially on the aluminum bed roll back wreckers, they find the need for a sturdier device.

Calls for quickly moving vehicles with broken ball joints continue to grow. While many use skates or Go-Jacks, many tow-ers find that due to their inability to safely load and secure a vehicle, especially on the aluminum bed roll back wreckers, they find the need for a sturdier device. We have also found that the shops where the towers drop the damaged vehicle has a similar problem because Go-Jacks do not work well outdoors, which result in many damaged floor jacks trying to move the vehicle into the shop. The 4th Wheel Loader with its two Polypropylene wheels works well in gravel and dirt to move the vehicle directly into the repair bays and frame racks.

We have also found that the shops where the towers drop the damaged vehicle has a similar problem because Go-Jacks do not work well outdoors, which result in many damaged floor jacks trying to move the vehicle into the shop. The 4th Wheel Loader with its two Polypropylene wheels works well in gravel and dirt to move the vehicle directly into the repair bays and frame racks.

3 SERIES TOW TRUCK LIFT

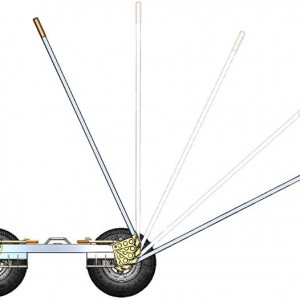

3 SERIES TOW TRUCK LIFT  Lift & Tow, the original creators of the hidden wheel lift, is a leader in providing solutions that make towing jobs easier and more efficient. 3 Series wheel lifts deliver a cost-effective way to get the professional towing capabilities you require without having to purchase a traditional tow truck. Our wheel lifts for sale are simple to install and use, saving you time and reducing the manual labor involved in towing cars and trucks.

Lift & Tow, the original creators of the hidden wheel lift, is a leader in providing solutions that make towing jobs easier and more efficient. 3 Series wheel lifts deliver a cost-effective way to get the professional towing capabilities you require without having to purchase a traditional tow truck. Our wheel lifts for sale are simple to install and use, saving you time and reducing the manual labor involved in towing cars and trucks.  The 3 Series is a slide-in wrecker boom that attaches to the underbody of your pickup truck and is completely hidden from view when not in use. It’s an excellent towing solution for municipalities and commercial towing companies as well as independent tow truck drivers and repo agents. The sub-frame is adjustable in width and length for the most versatile hidden tow boom available on the market with 3,500lbs lifting capacity, and 7,500lbs towing capacity. Your trucks will look and drive like normal, with the “hidden” ability to tow vehicles in as little as 35 seconds. The 3 series system costs just $3,995.00.

The 3 Series is a slide-in wrecker boom that attaches to the underbody of your pickup truck and is completely hidden from view when not in use. It’s an excellent towing solution for municipalities and commercial towing companies as well as independent tow truck drivers and repo agents. The sub-frame is adjustable in width and length for the most versatile hidden tow boom available on the market with 3,500lbs lifting capacity, and 7,500lbs towing capacity. Your trucks will look and drive like normal, with the “hidden” ability to tow vehicles in as little as 35 seconds. The 3 series system costs just $3,995.00. Lift & Tow’s 5 series system is the advanced version of the 3 series system.

Lift & Tow’s 5 series system is the advanced version of the 3 series system. A brand-new product has just been released, our very own line of Wheel Dollies. These dollies come in either a #3000lb or 4,000lb capacity. These new dollies are heavy duty and weigh about 52lbs per. The dollies use a cam lock, locking mechanism, are very user friendly, and have an upgraded crossbar with heavy duty locking pins. The dollies use sealed bearings for longer life and are repairable and rebuildable. Visit www.liftandtow.com today, and check out our full line of products, all proudly American made!.

A brand-new product has just been released, our very own line of Wheel Dollies. These dollies come in either a #3000lb or 4,000lb capacity. These new dollies are heavy duty and weigh about 52lbs per. The dollies use a cam lock, locking mechanism, are very user friendly, and have an upgraded crossbar with heavy duty locking pins. The dollies use sealed bearings for longer life and are repairable and rebuildable. Visit www.liftandtow.com today, and check out our full line of products, all proudly American made!.

If you are in the repo business, it’s likely that you already know what you’re looking for: a durable truck that gets the job done efficiently. Look no further than the Jerr-Dan MPL-NG or MPL-NGS models. Jerr-Dan’s standard wrecker line-up includes an MPL-NG and MPL-NGS that offer a quick and speedy recovery. Sold by authorized Jerr-Dan distributors, either model offers you durability, versatility, and the efficiency to get the job done. The underlift on both models come standard with a 90-degree pivoting head, with an 8,000 lb. winch option or without a winch – allowing you to recover a parallel parked vehicle with ease.

If you are in the repo business, it’s likely that you already know what you’re looking for: a durable truck that gets the job done efficiently. Look no further than the Jerr-Dan MPL-NG or MPL-NGS models. Jerr-Dan’s standard wrecker line-up includes an MPL-NG and MPL-NGS that offer a quick and speedy recovery. Sold by authorized Jerr-Dan distributors, either model offers you durability, versatility, and the efficiency to get the job done. The underlift on both models come standard with a 90-degree pivoting head, with an 8,000 lb. winch option or without a winch – allowing you to recover a parallel parked vehicle with ease. Other features on both models include multiple grid options from manual L-Arms, pivoting L-Arms, or fixed L-Arms. Whether you are towing low-clearance sports cars or motorcycles, the customizable wheel lift packages for each model let you take on more jobs, faster.

Other features on both models include multiple grid options from manual L-Arms, pivoting L-Arms, or fixed L-Arms. Whether you are towing low-clearance sports cars or motorcycles, the customizable wheel lift packages for each model let you take on more jobs, faster.

135 miles – 35 of those through rough dirt roads, 100 highway miles. That is the recent log of a professional tower, one of many throughout the week that come in from motorists being stranded or local businesses servicing vehicles. Each one an opportunity to help, grow business and provide for a family. On this particular 90-degree day, the vehicle was off the beaten path (literally an unpaved road) in the eastern Oregon desert hundreds of miles from town round-trip, leaving the tower to figure out a way to bring the vehicle back safely. So, he turned to his equipment – a wheel lift and Collins Dollies, confident that they could shoulder the load down the rough, dusty track. Confident because he’s done it before. Therefore, he chooses Collins Dollies.

135 miles – 35 of those through rough dirt roads, 100 highway miles. That is the recent log of a professional tower, one of many throughout the week that come in from motorists being stranded or local businesses servicing vehicles. Each one an opportunity to help, grow business and provide for a family. On this particular 90-degree day, the vehicle was off the beaten path (literally an unpaved road) in the eastern Oregon desert hundreds of miles from town round-trip, leaving the tower to figure out a way to bring the vehicle back safely. So, he turned to his equipment – a wheel lift and Collins Dollies, confident that they could shoulder the load down the rough, dusty track. Confident because he’s done it before. Therefore, he chooses Collins Dollies. Collins Hi-Speed Dollies came about to increase the safety and speed that a vehicle could be recovered. Prior to that, dollies were completely assembled underneath a vehicle after using a jack to raise it high enough. Though a great invention for their time and capabilities, these pan dollies were heavy and exposed the operator to roadside hazards for an extended period because of the time it took to assemble. Collins Hi-Speed Dollies improved upon this concept and changed the towing industry with a self-loading dolly in 1972. Their Hi-Speed name is partly due to quicker setup and tow times since the dollies themselves were used to raise the vehicle.

Collins Hi-Speed Dollies came about to increase the safety and speed that a vehicle could be recovered. Prior to that, dollies were completely assembled underneath a vehicle after using a jack to raise it high enough. Though a great invention for their time and capabilities, these pan dollies were heavy and exposed the operator to roadside hazards for an extended period because of the time it took to assemble. Collins Hi-Speed Dollies improved upon this concept and changed the towing industry with a self-loading dolly in 1972. Their Hi-Speed name is partly due to quicker setup and tow times since the dollies themselves were used to raise the vehicle. Collins Hassell, the namesake of Collins, had an entrepreneurial background gained through life’s experiences in creatively solving problems and caring for his family. During the 1940-50s while driving log trucks and hauling timber, Collins and his brother designed and manufactured improved log bunks and stakes for trucks that are still in use today. They had to be strong enough to carry a load of 50,000 pounds on trips from the forest to the mills, which could be a hundred miles or more (large portions of it on dangerous, washboard roads). Much of the materials and engineering for the bunks are like what would become the original self-loading dolly in 1972.

Collins Hassell, the namesake of Collins, had an entrepreneurial background gained through life’s experiences in creatively solving problems and caring for his family. During the 1940-50s while driving log trucks and hauling timber, Collins and his brother designed and manufactured improved log bunks and stakes for trucks that are still in use today. They had to be strong enough to carry a load of 50,000 pounds on trips from the forest to the mills, which could be a hundred miles or more (large portions of it on dangerous, washboard roads). Much of the materials and engineering for the bunks are like what would become the original self-loading dolly in 1972. So, what does this mean for you? How many times have you needed a tool and been frustrated that you do not have it, cannot find it, isn’t the right one or it does not exist? Maybe you were able to make do with what you had (a refined skill among operators), but wish it had not taken extra time, reduced profit, or lost business. In recovery and repossession scenarios, this could look like: turning away potential clients, lost time calling additional trucks to move a vehicle because the first one could not handle it, risking personal injury or vehicle damage.

So, what does this mean for you? How many times have you needed a tool and been frustrated that you do not have it, cannot find it, isn’t the right one or it does not exist? Maybe you were able to make do with what you had (a refined skill among operators), but wish it had not taken extra time, reduced profit, or lost business. In recovery and repossession scenarios, this could look like: turning away potential clients, lost time calling additional trucks to move a vehicle because the first one could not handle it, risking personal injury or vehicle damage. One operator can load the dollies under a vehicle and quickly lift it. The quickest time we have encountered is 60 seconds, from off the truck to vehicle lifted! With a little training, an operator or agent can recover AWD, electric/hybrid, vehicles that are disabled or stuck in park using the same dollies and wheel lift to get all four wheels off the ground and the job done.

One operator can load the dollies under a vehicle and quickly lift it. The quickest time we have encountered is 60 seconds, from off the truck to vehicle lifted! With a little training, an operator or agent can recover AWD, electric/hybrid, vehicles that are disabled or stuck in park using the same dollies and wheel lift to get all four wheels off the ground and the job done.  For those operating a flatbed truck instead of a wrecker, Collins Carrier Dolly gives you a damage-free, efficient way to load and unload vehicles. They effectively raise the vehicle for greater ground clearance, make for quicker loading and unloading and opens possibilities for towing a wider range of cars – electric, AWD, high performance and luxury vehicles. Should you come across vehicles without wheels because they were stolen or removed to prevent repossession, the Tow Cradle fits both Hi-Speed Dollies and Carrier Dollies to support the rotor and allow for recovery.

For those operating a flatbed truck instead of a wrecker, Collins Carrier Dolly gives you a damage-free, efficient way to load and unload vehicles. They effectively raise the vehicle for greater ground clearance, make for quicker loading and unloading and opens possibilities for towing a wider range of cars – electric, AWD, high performance and luxury vehicles. Should you come across vehicles without wheels because they were stolen or removed to prevent repossession, the Tow Cradle fits both Hi-Speed Dollies and Carrier Dollies to support the rotor and allow for recovery.

Established in 1982, Dynamic Manufacturing began its operations in an 8,000 square foot building in Norfolk, Virginia.

Established in 1982, Dynamic Manufacturing began its operations in an 8,000 square foot building in Norfolk, Virginia. The creators and executive team at Dynamic Manufacturing were the innovators in the repossession and towing industry. Calvin Russ, the company’s founder, started Dynamic Manufacturing by sketching out an idea to design a wheel-lift system that would be easier, faster, and safer to operate than what was available at the time. His creation, the Original Self-Loading Wheel-Lift, was born and Dynamic Manufacturing consistently worked to perfect the Self-Loading Wheel-Lift. Today, the Self-Loading Wheel-Lift is the most sought-after technology in the industry.

The creators and executive team at Dynamic Manufacturing were the innovators in the repossession and towing industry. Calvin Russ, the company’s founder, started Dynamic Manufacturing by sketching out an idea to design a wheel-lift system that would be easier, faster, and safer to operate than what was available at the time. His creation, the Original Self-Loading Wheel-Lift, was born and Dynamic Manufacturing consistently worked to perfect the Self-Loading Wheel-Lift. Today, the Self-Loading Wheel-Lift is the most sought-after technology in the industry.  The company’s mainstay was the 601 series with a 4,000-pound wheel-lift. This unit has now been bypassed with the 701 with its 5000lb wheel-lift fully extended, and optional Neg-Power tilt. With the 701’s impressive array of standard equipment, it is available in four different configurations: the B, which is the basic unit with the 5,000 pound wheel-lift; the BDW, a bed with a deck winch; the BSW, a bed with a recovery boom and a single winch; and the BTW, a bed with a recovery boom and two winches and numerous optional equipment is available to qualify for city and state towing contracts.

The company’s mainstay was the 601 series with a 4,000-pound wheel-lift. This unit has now been bypassed with the 701 with its 5000lb wheel-lift fully extended, and optional Neg-Power tilt. With the 701’s impressive array of standard equipment, it is available in four different configurations: the B, which is the basic unit with the 5,000 pound wheel-lift; the BDW, a bed with a deck winch; the BSW, a bed with a recovery boom and a single winch; and the BTW, a bed with a recovery boom and two winches and numerous optional equipment is available to qualify for city and state towing contracts. The 701 light duty and light/medium duty truck series and the 801 medium duty truck series are also available in the four different configurations. The 701 series offers a 5,000-pound wheel-lift and is also available with optional winch or negative tilt. The 801 series is the truck that Dynamic designed for the Virginia Department of Transportation and is available with an 8,000 pound wheel-lift. Dynamic Manufacturing totally reengineered the 801 series with an 8500LB wheel-lift and 16-ton recovery boom to meet their needs!

The 701 light duty and light/medium duty truck series and the 801 medium duty truck series are also available in the four different configurations. The 701 series offers a 5,000-pound wheel-lift and is also available with optional winch or negative tilt. The 801 series is the truck that Dynamic designed for the Virginia Department of Transportation and is available with an 8,000 pound wheel-lift. Dynamic Manufacturing totally reengineered the 801 series with an 8500LB wheel-lift and 16-ton recovery boom to meet their needs! Dynamic Manufacturing is continuing to broaden its product line. Dynamic was the first to manufacture rollbacks with a Self-Loading, Independent, Wheel-Lift. The traditional “L” arm wheel-lift is offered as standard equipment. As time progressed, methods of towing vehicles and trucks also required more diligence when towing. Dynamic saw the need to manufacture equipment that would help the tower be able to not only perform his job safely, but also with the delicate care needed to tow the present and future vehicles and trucks. The latest products introduced and now manufactured by Dynamic are the RADIUS Rotator Carrier, Slide-in Units, and the Stealth Wheel-Lifts. Dynamic offers a full line of products that can transform your pick-up into a wrecker at a low cost, and it makes for the perfect setup for low clearance garages! The latest addition to the lineup is the Dynamic Service vehicle. Make sure you visit

Dynamic Manufacturing is continuing to broaden its product line. Dynamic was the first to manufacture rollbacks with a Self-Loading, Independent, Wheel-Lift. The traditional “L” arm wheel-lift is offered as standard equipment. As time progressed, methods of towing vehicles and trucks also required more diligence when towing. Dynamic saw the need to manufacture equipment that would help the tower be able to not only perform his job safely, but also with the delicate care needed to tow the present and future vehicles and trucks. The latest products introduced and now manufactured by Dynamic are the RADIUS Rotator Carrier, Slide-in Units, and the Stealth Wheel-Lifts. Dynamic offers a full line of products that can transform your pick-up into a wrecker at a low cost, and it makes for the perfect setup for low clearance garages! The latest addition to the lineup is the Dynamic Service vehicle. Make sure you visit

Did someone damage your tow truck?

Did someone damage your tow truck?

F

F

D

D I’m sure you can add to the list.

I’m sure you can add to the list. If our country goes socialist there is no coming back.

If our country goes socialist there is no coming back.

W

W Generally, I prefer not using analogies, but I need to make this comparison.

Generally, I prefer not using analogies, but I need to make this comparison. I’ve talked to a bunch of people in the industry recently and have gotten similar responses to the question of how business is going.

I’ve talked to a bunch of people in the industry recently and have gotten similar responses to the question of how business is going.

There’s always a lot happening at the

There’s always a lot happening at the  Additionally, one of TRAA’s key focuses is bringing new people into the industry. In June TRAA launched its newest book, How to Become a Tow Truck Operator which is now available for e-reader and paperback on Amazon. This is a short, no-nonsense guide to a career as an operator in the towing and recovery industry. The book provides an overview of the work towers do, a tow truck driver job description, a look at tow truck driver requirements, information on tow truck driver income and salary, tips on finding a job in the towing industry and more. How to Become a Tow Truck Operator is a must-read for anyone considering a career in towing and recovery!

Additionally, one of TRAA’s key focuses is bringing new people into the industry. In June TRAA launched its newest book, How to Become a Tow Truck Operator which is now available for e-reader and paperback on Amazon. This is a short, no-nonsense guide to a career as an operator in the towing and recovery industry. The book provides an overview of the work towers do, a tow truck driver job description, a look at tow truck driver requirements, information on tow truck driver income and salary, tips on finding a job in the towing industry and more. How to Become a Tow Truck Operator is a must-read for anyone considering a career in towing and recovery!

Over the years,

Over the years,

The

The