The use of technology continues to rise in the towing and roadside industry, so do consumer expectations. With the ability to use advanced technology at your fingertips, your customer expects to be informed and cared for every step of the way. Using Towbook facilitates this communication by doing the work for you!

Towbook not only promotes continuous communication with your customers, but also with your motor clubs, body shops, dealerships, police departments, and private property managers too!

Got a call from the motor club? Accept it with the click of a button!

Does your body shop or dealership want to send you a job? Our Web Request Portal can help them do exactly that with just a few clicks!

Impress your police departments with “Vehicle Lookup” technology that allows them to quickly see if a certain vehicle is on your lot!

Give private property managers a login to their account, so they can view all vehicles that were towed and sign for them as well!

All of the above actions and more, allow you and your staff to reduce time on the phone and maximize your performance and efficiency.

So, what does Towbook do? And why do you need it?

Improved Communication

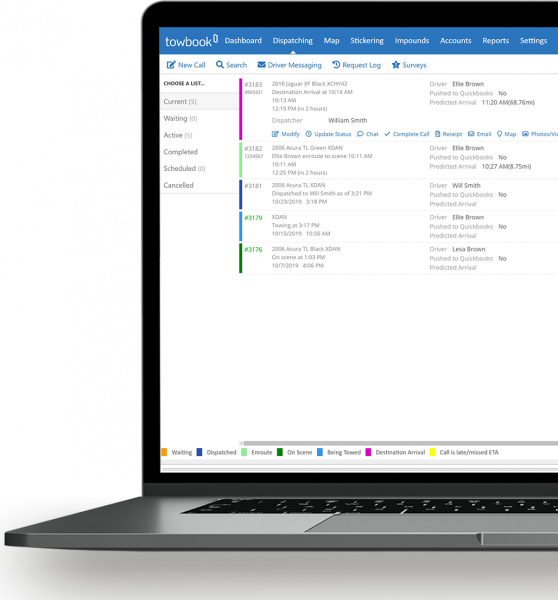

Managers and dispatchers can communicate with drivers easily. Drivers can accept calls with all the details needed in order to do their job efficiently and update the status of the job from start to finish. You will also be able to chat with your drivers via their mobile applications or send them a text message to make them aware of last-minute changes (chat logs are always saved to the call for future reference).

Managers and dispatchers can communicate with drivers easily. Drivers can accept calls with all the details needed in order to do their job efficiently and update the status of the job from start to finish. You will also be able to chat with your drivers via their mobile applications or send them a text message to make them aware of last-minute changes (chat logs are always saved to the call for future reference).

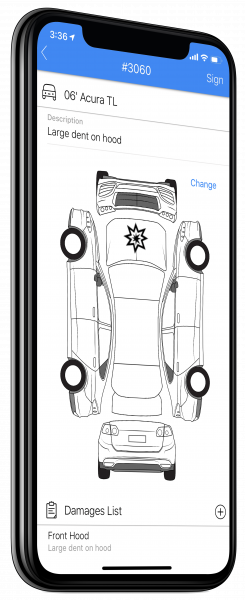

Minimize Risk of Damage Claims

Drivers can upload photos of the vehicle to a call in real-time; we timestamp and geocode these photos for you along with categorizing them according to what job status the driver was in at the time. An additional precaution can be taken by creating a “Vehicle Damage Form” if there is extensive damage to the vehicle prior to servicing it. The driver can create a report on scene, take photos of the vehicle, indicate anywhere there is damage, and have the customer sign off on the damage form. This report will be saved for future reference and can even be emailed or sent via text to the customer with their receipt.

Roadside.io

Towbook’s Roadside.io solution, paired with our Customer Survey feature, delivers the latest customer experience capabilities to your fingertips, allowing you to provide an “Uber-like” experience for your customers.

Towbook’s Roadside.io solution, paired with our Customer Survey feature, delivers the latest customer experience capabilities to your fingertips, allowing you to provide an “Uber-like” experience for your customers.

With Roadside.io, you have the option of sharing information with customers while the service is in progress; helping customers understand what’s happening with their service without having to call you for an update. You also have the option of sending the customer a satisfaction survey once the job is complete. You can choose to push these surveys to your website and you can also direct them to your social media outlets where they can complete a review about the service they received.

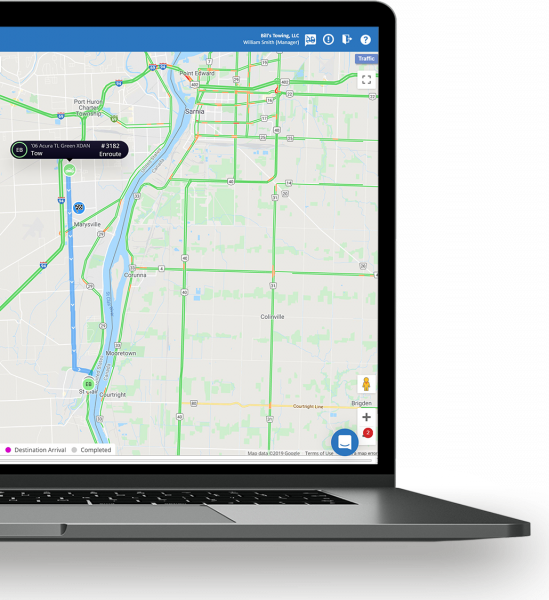

Built-in Navigation and GPS Tracking

You’ll be able to get turn-by-turn directions to your destination right in the application with just a tap!

You’ll be able to get turn-by-turn directions to your destination right in the application with just a tap!

If you aren’t currently using a GPS solution, Towbook is equipped with built-in GPS tracking which will automatically update the drivers’ location according to their app settings.

Towbook is also integrated with leading GPS companies like AT&T Fleet Complete, DriverLocate, Samsara, US Fleet Tracking , Verizon Connect, and Webfleet Solutions; allowing you to send calls directly to the GPS unit in your truck.

Drivers can use the GPS unit to navigate to the service location, and when they update the status of the call on the GPS unit it will automatically update their status in Towbook. Your Towbook app can also use the GPS location from your trucks and display that on the map in Towbook. There are many other fantastic features of GPS units that help you manage and maintain your fleet.

Pre-Trip Inspection Management and User Check-In.

If you want your team to inspect their trucks and other equipment before (or after) every shift, they can do that easily using the Towbook mobile apps and our Equipment Inspection tool. Each inspection report is time stamped, and managers will receive an email alert any time there is an Equipment Inspection failure.

Completed inspections are also available to open/view on mobile apps, so if drivers need to present a completed pre-trip inspection to a law enforcement officer they can do so right from their phone!

Our “User Check-In” feature allows drivers to check-in and out for work directly from their mobile application. This allows managers and dispatchers to know who is currently on-shift to accept jobs. You are also able to run a report to review check in/check out times for drivers.

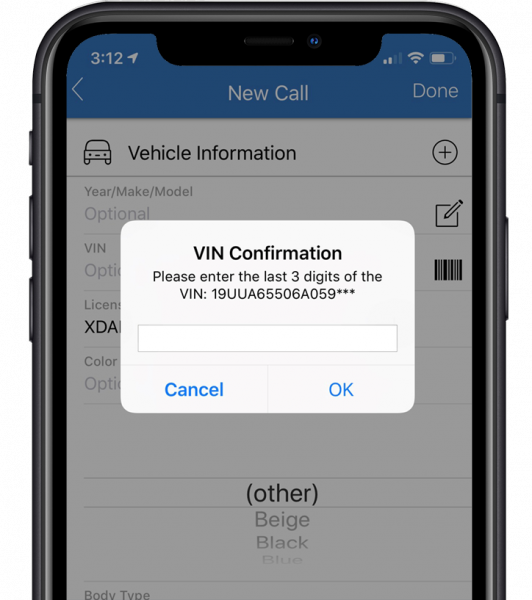

Plate-to-VIN Technology

No VIN – no problem! Towbook’s plate-to-VIN feature saves time and eliminates mistakes. Simply enter the plate number and the state in which the vehicle is licensed, and Towbook will return the full VIN with the make, model, and year of the vehicle. You’ll also have the option of using our VIN scanner, which will populate the VIN in the call just by scanning the vehicle’s barcode.

No VIN – no problem! Towbook’s plate-to-VIN feature saves time and eliminates mistakes. Simply enter the plate number and the state in which the vehicle is licensed, and Towbook will return the full VIN with the make, model, and year of the vehicle. You’ll also have the option of using our VIN scanner, which will populate the VIN in the call just by scanning the vehicle’s barcode.

Private-Property Features

Alongside tagging accounts, two of our most notable private property features for the mobile applications include “On Scene Call Creation” and “Stickering”.

On Scene Call Creation: This allows your drivers to do their job as quickly as possible by allowing them the option to create a call by simply snapping a picture of the vehicle; the call will automatically populate the address they’re located at and will allow them to update any additional details later.

Stickering: One of Towbook’s fastest-growing features is our Stickering app. With Stickering, you can create a virtual sticker in Towbook and “tag” those vehicles that you might be able to tow after a few hours or a few days. When the sticker expires, you receive a notification that the vehicle can be towed.

Impound/Storage Lot Management and Vehicle Lookup: You’ll be able to track and release your current impounded/stored vehicles on your lot right from the mobile application. You’ll even be able to send the impound invoice via text or e-mail.

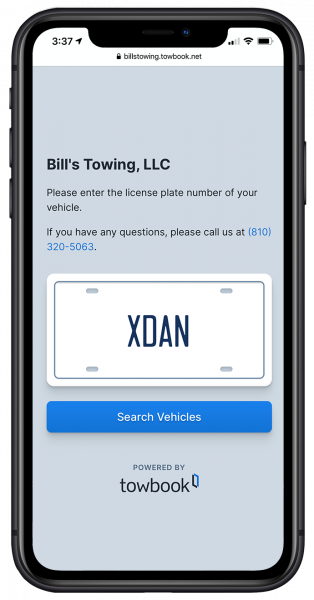

In using our “Vehicle Lookup” technology, your customers, police departments, and private-property accounts will thank you! It makes it simple for them to look and see if you have a certain vehicle on your lot without calling.

Digital Dispatching: Whether you are a dispatcher or manager sending out calls or an owner/operator working in the field, you’ll be able to accept motor club calls while out of the office or on the road using Towbook’s mobile apps. Towbook is integrated with all the major motor clubs for your convenience! A couple of taps to accept the call and you’ll be on your way!

Digital Dispatching: Whether you are a dispatcher or manager sending out calls or an owner/operator working in the field, you’ll be able to accept motor club calls while out of the office or on the road using Towbook’s mobile apps. Towbook is integrated with all the major motor clubs for your convenience! A couple of taps to accept the call and you’ll be on your way!

Paperless Invoicing: Save time by texting or emailing your customer an invoice right on-scene! If paper invoices are a must, we integrate with Zebra mobile printers to print your customers’ receipt on the spot.

Additional Information

On top of the many features we’ve already mentioned, your drivers will be able to add additional information to the call via their app according to the preferences setup by management, this includes:

- Additional line items/charges.

- Record payments received in the field.

- Collect customer signatures for archiving and appearing on receipts.

- Collect any additional notes regarding the service or customer.

- Record vehicle odometer.

- Add any company expenses, such as fuel along with a picture of the receipt for manager review.

Technology is causing a world-wide evolution and it’s important to find resources that can be of benefit to us. First it was computers, now it’s a little device in our pocket that we all rely on daily – whether for business or our personal lives.

Using software to manage your business increases efficiency and profitability but it’s also a great tool to woo potential clients; demonstrating that you are a forward-thinking towing/road service company and are interested in adapting to the ever-changing technological environment.

Towbook Management Software is the unquestioned leader in cloud-based towing software, headquartered in Michigan, and has provided service for over fourteen years. Integrating the industry’s most advanced and flexible software, Towbook supports all sizes and types of towing, recovery and roadside service operations.

We provide tools made possible by the latest technology, and we help companies to raise their level of service while lowering their operating costs.

Plus, our commitment to you will be never-ending! We take great pride in having the industry’s best customer support. Support is free and available 24/7/365—even on holidays.

What We Offer

Free Trial, Free Setup, Free Support

Towbook offers a 30-day free trial with free setup and support, and there are no contracts. Plus, you don’t need a separate Towbook license for each employee—your subscription always includes unlimited user accounts!

Website: www.towbook.com

Inquiries: sales@towbook.com

24/7/365 Support Line: (810) 320-5063

When I sold my company, I brought another company in to determine its value.

When I sold my company, I brought another company in to determine its value.

Mach1’s service coverage area has expanded quickly, as providers across the country have signed up to be a part of its network. As customer demand has increased, so has provider interest, leading to exponential growth, and a nationwide launch. Mach1 started the 2021 year with a 26 state coverage area and is able to expand to all 50 states as customers and providers have previously signed up with the veteran owned company.

Mach1’s service coverage area has expanded quickly, as providers across the country have signed up to be a part of its network. As customer demand has increased, so has provider interest, leading to exponential growth, and a nationwide launch. Mach1 started the 2021 year with a 26 state coverage area and is able to expand to all 50 states as customers and providers have previously signed up with the veteran owned company.

Versatile and future-proof tablet for tailored usage and control: Equipped with Google™ Services including push notifications to enhance seamless communication and access to the Google Play™ store including standard Google Apps™ (such as Chrome™, Gmail™, Google Maps™). Wireless connectivity with LTE supports fast download speeds, as well as Wi-Fi®, Bluetooth® and NFC/RFID for wireless communication and professional use.

Versatile and future-proof tablet for tailored usage and control: Equipped with Google™ Services including push notifications to enhance seamless communication and access to the Google Play™ store including standard Google Apps™ (such as Chrome™, Gmail™, Google Maps™). Wireless connectivity with LTE supports fast download speeds, as well as Wi-Fi®, Bluetooth® and NFC/RFID for wireless communication and professional use.

B

B ServiCase is different from other search services in that the provider is not charged for events or jobs they receive. There is no upcharge for receiving the call and under no circumstance does ServiCase attempt to control rates. Nothing is marked up because payment is made directly to the Service Provider.

ServiCase is different from other search services in that the provider is not charged for events or jobs they receive. There is no upcharge for receiving the call and under no circumstance does ServiCase attempt to control rates. Nothing is marked up because payment is made directly to the Service Provider.

A

A

Spring break for towers in sunny Florida will once again give towers a place to see new equipment and have fun with towers across the country.

Spring break for towers in sunny Florida will once again give towers a place to see new equipment and have fun with towers across the country.