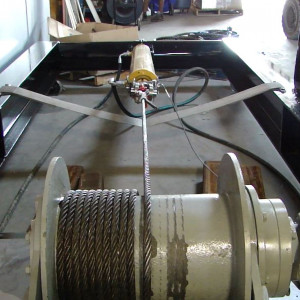

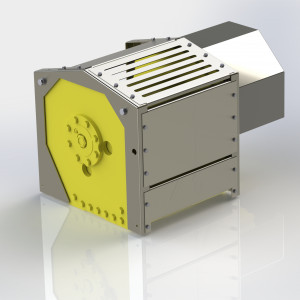

Survival in our changing transportation industry requires towers to work smarter and more efficiently. Today’s faster pace demands light weight equipment that can safely haul heavy loads at highway speeds while still meeting the scaling requirements of the state(s) you are operating within. A Tru-Hitch fulfills this need.

A Tru-Hitch Fifth Wheel Towing Device solves many of the traditional problems with heavy duty towing.

- Tows Heavy Loads and Doesn’t Overload Drive Axles- The Tru-Hitch booms are extended and then connected to the towed vehicle at a point behind the axle on the vehicle being lifted. This connection point places the axle being lifted in the middle of the effort being used to lift the truck for towing. Less effort is needed to lift heavy weight. Once lifted, the truck in tow is secured to the booms creating a rigid connection. The truck in tow simply becomes a semi-trailer. Weight transferred forward is properly imposed down onto the fifth wheel. This is how your tractor is designed to work and means no overloaded drive axles. Other fifth wheel attachments are attached in a fixed

manner to the after frame of tractor they are mounted onto and use a traditional stinger to lift at the axle directly. The lifting effort is out at the end of the stinger. This means the rearmost drive axle sees most of the weight and in many cases becomes severely overloaded.

-

No Special Tractors or Modifications Needed – A Tru-Hitch can be connected to or disconnected from any tractor in just a few minutes. The Tru-Hitch is simply connected at the fifth wheel, and when transported uses a small set of integrated travel legs that rest on the after frame of the tractor. When disconnected, the Tru-Hitch is free standing, without the need for support arms etc., ready to back under the next time you need it. Because the Tru-Hitch properly places weight onto, and pivots at the fifth wheel when towing, there are no special mounting brackets, binders, or fixed mounting points needed. Also, because towing with a Tru-Hitch places weight properly onto the fifth wheel, there is no need to stretch the frame of the tractor in an effort to get weight forward off the rear axle. Nor does a Tru-hitch need to have additional lift axles added to safely lift tow.

-

No Lightened or Unsafe Steering when Towing- Because the load becomes a semi-trailer when using a Tru-Hitch, the steering axle of the towing tractor actually GAINS weight! Your tractor acts normally. This leads us to another important point.

-

No Uneven Braking – Because there are no overloaded drive axles and the steering axle stays properly planted to the road this means the brakes are evenly loaded. This keeps your driver, the load, and the people traveling near you safer.

-

There are no pinch points when towing with a Tru-Hitch – Towed loads are secured to the Tru-Hitch booms and pivots at the fifth wheel. You can make turns at up to 90 degrees without worrying about pinch points. And just like a trailer, the load follows you around corners. Other under-lifts that pivot at the stinger mean maneuverability is limited. When you turn left the load wants to go right and vice versa. This is never an issue with a Tru-Hitch.

-

Cost- Traditional tow trucks are heavy, long, and expensive to operate. Other fifth wheel attachments require modified wheelbase tractors and complicated bracketry to mount and use. A Tru-Hitch comes complete, ready to attach to a standard tractor, with no special mounting requirements or additional cost. It can run on its own self-contained hydraulics, or connect it to a PTO, it’s your choice. Radio remote control and rigging items are included. A Tru-Hitch can lift up to 32,000 lbs. and tow up to a gross combined weight rating of 140,000 lbs. Tru-Hitch is the safest heavy duty towing solution for the heavy-duty tower.

Visit www.truhitch.com for more information, or call 860-379-7772 to order your Tru-Hitch today.

Apparently Taiwan makes all the computer chips for the world. There are countries fighting for control of Taiwan and until it is resolved they stopped producing computer chips.

Apparently Taiwan makes all the computer chips for the world. There are countries fighting for control of Taiwan and until it is resolved they stopped producing computer chips.

Before cashing a check, double check the front and back of it, as well as the stub and any enclosed letter. If you cash a check that has release language on it, you may be giving up any additional losses related to the claim.

Before cashing a check, double check the front and back of it, as well as the stub and any enclosed letter. If you cash a check that has release language on it, you may be giving up any additional losses related to the claim.

This proven military experience, and unwavering commitment to quality and performance, is built into every Tru-Hitch™ for the commercial tower. The Tru-Hitch™ fifth wheel towing device is cost effective to purchase, operate, and maintain. The Tru-Hitch™ heavy-duty under lift towing device utilizes the fifth wheel coupling as the pivotal connection between the pulling tractor and the truck in tow. What makes the Tru-Hitch™ unique is that it imposes a downward load and pivots on the towing tractor at the fifth wheel, rather than behind the tractor’s rear axle. The truck in tow essentially becomes a “semi-trailer”. The weight of the disabled vehicle is distributed among all axles of the towing tractor. The front axle of the towing tractor actually gains weight as the vehicle is lifted! This makes the Tru-Hitch™ by far the safest heavy duty towing device in the transportation industry

This proven military experience, and unwavering commitment to quality and performance, is built into every Tru-Hitch™ for the commercial tower. The Tru-Hitch™ fifth wheel towing device is cost effective to purchase, operate, and maintain. The Tru-Hitch™ heavy-duty under lift towing device utilizes the fifth wheel coupling as the pivotal connection between the pulling tractor and the truck in tow. What makes the Tru-Hitch™ unique is that it imposes a downward load and pivots on the towing tractor at the fifth wheel, rather than behind the tractor’s rear axle. The truck in tow essentially becomes a “semi-trailer”. The weight of the disabled vehicle is distributed among all axles of the towing tractor. The front axle of the towing tractor actually gains weight as the vehicle is lifted! This makes the Tru-Hitch™ by far the safest heavy duty towing device in the transportation industry